Sale & Purchase

Whether you're a layman looking to understand your own transaction or a lawyer needing assistance with a client's conveyancing our step by step sale and purchase guides will lead you through the process while our mini guides will break the whole thing into manageable chunks and give a deep insight into the key issues and stages. Leasehold, freehold, unregistered, registered – we've got it all covered.

Pre-Exchange

Post-Exchange

Overview

Documents & Guides

- Board Minutes And Resolut...

- Contract - Registered Land

- Contract - Unregistered L...

- Contract - Unregistered L...

- Deed Of Variation For Ren...

- Epitome Of Title

- Fixtures, Fittings & Cont...

- Flat Lease - Specimen

- Guide To Standard Conditi...

- House Lease - Specimen

- Leasehold Contract

- Leasehold Example Enquiries

- Leasehold Information Form

- National Conditions Of Sa...

- Notice Of Assignment

- Notice Of Assignment & Ch...

- Property Report

- Purchase Completion State...

- Rentcharge Deed Of Covena...

- Replies To Requisition On...

- Requisition On Title

- Sale Completion Statement

- Sample Drainage Search Re...

- Sample Office Copy Entries

- Sellers Property Informat...

- Statutory Declaration As ...

- Statutory Declaration As ...

Remortgages & Transfers

Need help with a remortgage or transfer of equity / deed of gift? Our guides will walk you through the process and highlight some of the common pitfalls. Mortgages and transfers can be very simple procedures but complex issues can sometimes arise and mistakes are easily made. These guides will help you deal with them.

Remortgages

Transfers & Gifts

Documents & Guides

DIY Conveyancing / General

So you want to have a go at your own conveyancing? First you should read about the risks, then if you're still happy to proceed, our guides will take you through each stage of the process telling you what to look out for and helping you avoid falling into expensive traps. Our subscription service will give you access to all of the documents you should need for your conveyancing and we can even supply you with the Land Registry Official Copies you'll need. Our general guides will cover all the obstacles you are likely to face and offer a practical solution. Have a look at our sale and purchase guides too.

General Guides

Conveyancing Searches

A big part of the conveyancing process is the conveyancing searches. This section tells you all about them. What they are, how and when to order them and how to interpret the results. Each search has its own guide and you'll see they are separated into Standard (should be done in every case), Regional (area specific) and Optional (not essential but often useful tools for the would be purchaser). All buyers should beware that when you buy a property, the law assumes that you have seen the information that would have been revealed by searches whether or not you have actually carried them out, so you buy the property subject to the results.

Standard

Regional

Optional

Quote Request

Using a conveyancer to handle your conveyancing will greatly reduce the risk to you and sometimes, particularly if you are taking out a new mortgage, you will have no choice but to instruct a conveyancer. The good news is it doesn't have to break the bank. Get a free, instant quote here. We can also help with quick easy quotes for other moving related services.

Order

Are you looking for the documents you'll need for your conveyancing transaction? Or official copies of the title or other documents from Land Registry. We can help you. Follow the links below.

Professional Services

Documents & Resources

Sale & Purchase

-

What are Conveyancing Disbursements

Disbursements are cost which are payable as part of a conveyancing transaction via your conveyancer to third parties. These are costs which do not form part of a conveyancer's fees. The following are some of the more common disbursements that you mig...

-

Completing the Conveyancing Transaction

Completion Day Order of Events The buyer's conveyancer should ensure that he has both the mortgage funds (if a mortgage is required) and funds from his client no later than the working day before completion. This is because the funds will most likely...

-

Land Registry Pre-completion Searches

The purpose of the pre-completion searches is to prevent entries being registered against the property (or in the case of the bankruptcy search, the purchaser) from exchange of contracts up to the completion of the registration process, so that the b...

-

Exchange of Contracts

What is Exchange of Contracts? This is when the contract becomes legally binding on both buyer and seller (note that merely signing it does not bind either party). It is so called because both buyer and seller sign identical copies of the contract an...

-

Mortgage Offers

When acting for a purchaser who is buying with a mortgage the conveyancer will, on the vast majority of occasions, also act for the lender. It should be noted that no commercial (as opposed to private) lender will allow the purchaser to carry out his...

-

Sellers Property Information Form (SPIF)

The Seller's Property Information Form TA6, often shortened to SPIF is part of the Law Society's National Conveyancing Protocol and should be completed by the seller(s). This chapter will take you through the SPIF produced by the Law Society and dist...

-

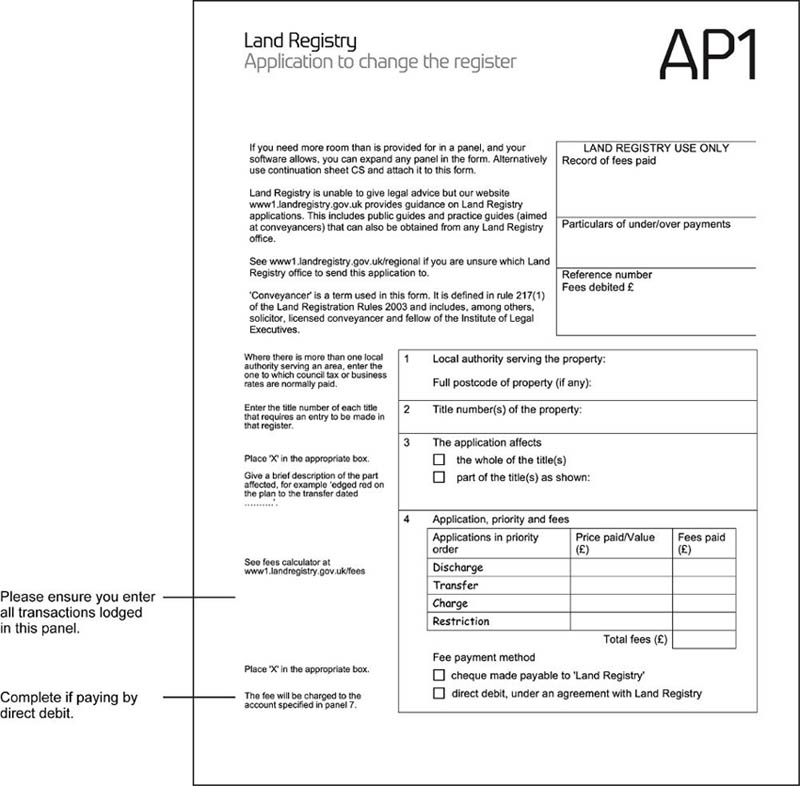

Application for Registration

Making the Application for Registration (AP1) What is Registration? Registration is the process by which a land transaction (such as a purchase, remortgage, transfer of equity, deed of gift etc.) is notified to H M Land Registry and by which the regi...

-

Deducing Title to Unregistered Land

Under the Land Registration Act 2002 (which repealed the Land Registration Act 1925) it is compulsory for all land in England and Wales to be registered with the Land Registry. The trigger for registration is a change of ownership, such as a sale, gi...

-

Requisitions on Title

What are Requisitions on Title? These are a set of questions, usually in the Law Society's standard Completion Information and Requisitions on Title form designed to ensure that certain key information is obtained prior to completion. They are r...

-

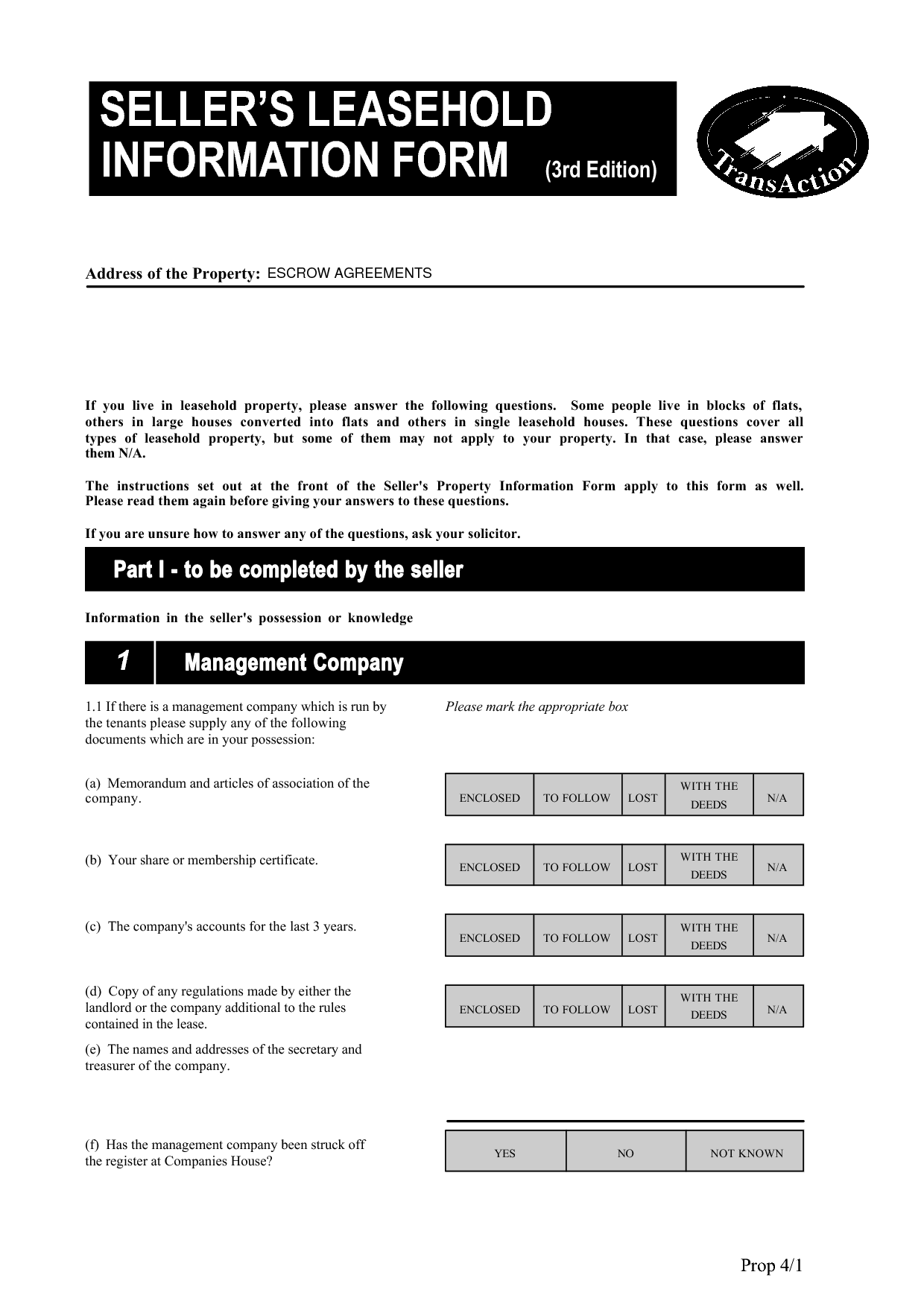

Sellers Leasehold Information Form (SLIF)

The leasehold information form (TA7) is one of the standard Law Society protocol forms used in transactions where the property is leasehold. It is completed by the seller in addition to the Property Information Form and asks a serious of questions sp...

-

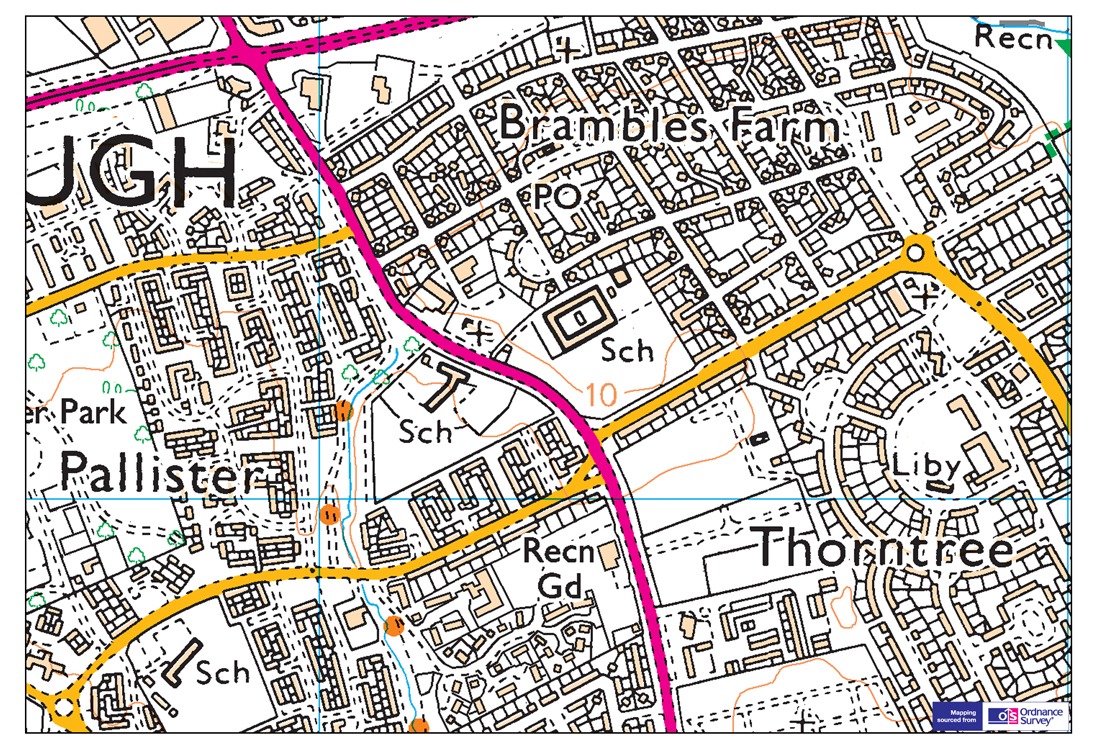

Official Copy Entries

In the case of registered land, the land registry's registers contain all the details of the title to a property. An Official Copy of the register is therefore the equivalent of a full set of title deeds (save that a register entry may sometimes refe...

-

Transfer Deed

Introduction This chapter explains how to draft the property transfer deed, which is the document which is submitted to HM Land Registry to transfer ownership of the legal title to land. If you are looking to carry out a property transfer yourself th...

-

Shared Ownership Conveyancing

Shared ownership is a scheme where a landlord, usually a Housing Association (HA) or other Registered Social Landlord (RSL) will sell a percentage share of a property to a purchaser and retain the remaining share. It is designed to help people get on...

-

Sale Conveyancing Guide

Introduction to the Sale Conveyancing Tutorial What follows in this page is a comprehensive guide to carrying out the conveyancing in the sale of a property. It covers freehold, leasehold, registered and unregistered land. It is separated into sectio...

-

Purchase Conveyancing Guide

Guide to Conveyancing on a Purchase This section is a step-by-step guide to carrying out the conveyancing for the purchase of a property. If you are not a solicitor or conveyancer and you are intending on carrying out your own conveyancing you shoul...

-

Example Pre-Contract Enquiries

The purpose of this chapter is to offer some useful wording for pre-contract enquiries which might need to be raised in respect of some of the more common issues not covered by the Sellers Property Information Form, Sellers Leasehold Information Form...

-

Types of Property Surveys

When buying a property, having a proper survey done should be the top of your list of priorities. After all, you wouldn't buy a car without an MOT certificate and the average house costs perhaps 50 times as much as the average car! It is true that a ...

-

Overview of Removal Services

When moving home, booking your removals shouldn't be an afterthought. You need to plan it because if something goes wrong you could be looking at serious expense and inconvenience on the day of completion. At the start of your conveyancing transacti...

-

Stamp Duty Land Tax (SDLT)

Stamp Duy Land Tax This article is about Stamp Duty Land Tax which applies to properties in England only. For properties in Wales, the equivalent tax is Land Transaction Tax (LTT). For information on LTT click here. What is Stamp Duty Land ...

-

Contracts for Conveyancing

The contract, (sometimes referred to as an agreement), is the legal contract between the buyer and seller for the purchase/sale of the property. It contains the terms of the contract, such as the price, the completion date, the amount of deposit paid...

-

Standard Conditions of Sale (5th Edition) Guide

The standard conditions of sale are a set of Law Society produced contract conditions to which the vast majority or residential sale contracts are subject. A solicitor is not obliged to incorporate the standard conditions of sale into any contract he...

-

Dealing with Rentcharges and Estate Rentcharges

What is a rentcharge? A rentcharge, as defined by s1 Rentcharges Act 1977, is “any annual or other periodic sum charged on or issuing out of land, except— (a)rent reserved by a lease or tenancy, or (b)any sum payable by way of interest...

-

Building Safety Act 2022

Building Safety Act 2022 The Building Safety Act 2022 introduced a number of new measures in relation to building safety, affecting buildings of 11m (or 5 storeys) and more – now known as “relevant buildings”. The UK Finance Mortga...